Don’t let retirement catch you off guard. Securing a comfortable and fulfilling retirement requires thoughtful planning and proactive saving. This guide is your roadmap to financial freedom, including important considerations like pensioner car loans.

We understand that retirement is more than just numbers; it’s about enjoying the golden years on your terms. Whether you dream of travelling the world, pursuing hobbies, or simply relaxing, this guide will help you transform your aspirations into a solid financial plan.

We’ll cover everything from setting clear retirement goals to crafting an effective savings strategy. By the end of this guide, you’ll have the knowledge and confidence to build a secure financial future.

Understanding Your Retirement Goals

Picture your perfect retirement. Are you dreaming of leisurely days on a sunny beach, exploring the outback in a caravan, or pursuing hobbies like gardening or golf? Your vision of retirement is unique, and it’s essential to define it clearly. This vision will guide your savings and investment decisions.

Visualise your ideal retirement:

- Envision your dream lifestyle: What activities, hobbies, or experiences bring you joy? Consider whether you prefer a relaxed pace or an active retirement.

- Location matters: Think about where you’d like to spend your retirement years. Do you prefer the coast, the countryside, or a bustling city?

- Social connections: Consider how important social interaction is to you. Will you be spending time with family, and friends, or joining clubs and groups?

Assess your desired lifestyle:

- Housing options: Evaluate your current living situation and consider whether downsizing or relocating is suitable for your retirement goals.

- Location preferences: Determine the ideal location based on factors like climate, access to amenities, and cost of living.

- Lifestyle factors: Consider your desired level of activity, access to healthcare, and proximity to family and friends.

Estimate your retirement expenses:

- Housing costs: Calculate potential expenses such as mortgage payments, rent, property taxes, utilities, and home maintenance.

- Healthcare: Estimate costs for private health insurance, medications, dental care, and potential long-term care.

- Travel and leisure: Budget for vacations, hobbies, entertainment, and dining out.

- Everyday living: Account for groceries, transportation, utilities, and other regular expenses.

Calculate your total retirement income needs:

- Add up your estimated expenses: Create a comprehensive budget to determine your annual income requirements.

- Consider inflation: Factor in the potential increase in living costs over time.

- Set a savings goal: Determine how much you need to save to achieve your desired retirement lifestyle.

By carefully considering these factors, you can create a realistic retirement plan tailored to your specific needs and aspirations.

Remember: Regular review and adjustments to your plan may be necessary as your circumstances change.

Superannuation: The Cornerstone of Australian Retirement

By diligently contributing to your super fund throughout your working life, you’re building a financial foundation for your golden years. This guide will empower you to make informed decisions about your retirement savings, ensuring a comfortable and fulfilling lifestyle.

The Importance of Superannuation

Superannuation is a cornerstone of retirement planning in Australia. It’s a compulsory savings scheme where a portion of your salary is contributed to a superannuation fund. This money grows over time through investment, providing a vital income source during retirement.

Different Types of Superannuation Accounts

- Retail super funds: These are offered by banks, insurance companies, and other financial institutions. They provide a range of investment options and services.

- Industry super funds: Established by industry sectors (e.g., mining, construction), they often offer lower fees and strong performance.

- Self-managed super funds (SMSFs): This type of fund gives you complete control over investments but involves significant administrative responsibilities.

- Corporate super funds: Offered by large employers, these funds typically provide a range of investment options and services.

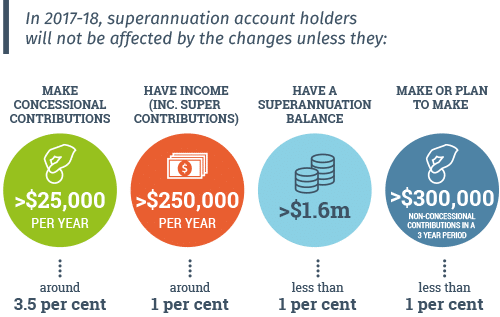

Contribution Limits and Tax Implications

- Employer contributions: Your employer is legally obligated to contribute a percentage of your salary to your super fund.

- Personal contributions: You can also make voluntary contributions to your super fund, which may attract tax benefits.

- Contribution caps: There are annual limits on the amount you can contribute to your super fund.

- Tax advantages: Superannuation offers significant tax benefits, including concessional tax rates on contributions and earnings.

Strategies for Maximising Superannuation Growth

- Early start: The earlier you start contributing to your super, the more time your money has to grow.

- Regular contributions: Consistent contributions, even small amounts, can make a big difference over time.

- Investment choice: Choose investment options that align with your risk tolerance and long-term goals.

- Consolidation: Combining multiple super accounts can help reduce fees and improve investment performance.

- Seek professional advice: Consider consulting a financial advisor to create a tailored superannuation strategy.

Government Benefits and Pensions

Age Pension Eligibility and Requirements

The Age Pension is a government payment available to eligible Australians who have reached retirement age. Eligibility is based on income and assets tests. Factors such as age, residency, and work history also influence eligibility.

Other Government Benefits for Retirees

Apart from the Age Pension, the Australian government offers other benefits to retirees, including:

- Carer Payment: For those caring for a person with a disability or chronic illness.

- Pension Supplement: An extra payment for eligible pensioners.

- Commonwealth Seniors Health Card: Provides access to lower-cost medications and other benefits.

Understanding Centrelink and Medicare

- Centrelink: This government agency administers various social security payments, including the Age Pension and other benefits.

- Medicare: Australia’s universal healthcare system provides subsidised medical care for eligible residents.

Note: The Age Pension and other government benefits are subject to change. It’s essential to stay informed about the latest eligibility criteria and payment rates.

Investment Strategies for Australians

Diversifying Your Investment Portfolio

To manage risk and potentially increase returns, it’s essential to diversify your investments across different asset classes. While Australian investments offer opportunities, consider diversifying globally to reduce exposure to domestic economic fluctuations.

Investment Options

- Low-risk investments:

- Australian government bonds: Generally considered safe, these bonds offer regular interest payments but typically have lower returns compared to other investments.

- Term deposits: Provide a fixed interest rate for a specified period, offering a low-risk way to save money.

- Moderate-risk investments:

- Australian shares: Investing in Australian companies can provide capital growth and dividends. However, the performance of individual companies can vary.

- Managed funds: Professionally managed portfolios of various assets, offering diversification and potential growth.

- High-risk investments:

- Property: Investing in property can offer rental income and capital growth, but it’s also subject to market fluctuations.

- International shares: Investing in overseas companies can diversify your portfolio and potentially offer higher returns, but it’s also subject to currency fluctuations and geopolitical risks.

Building a Balanced Portfolio

Consider your risk tolerance, investment horizon, and financial goals when constructing your investment portfolio. A balanced approach often involves combining low-, moderate-, and high-risk investments to manage risk and optimise returns.

Retirement Planning Tools and Resources

Utilising Available Resources

There are various tools and resources available to assist you in your retirement planning:

- Australian Government Retirement Calculators: Online tools provided by the government can help you estimate your retirement income needs and savings goals.

- Financial Advisors and Planners: Professional advice can provide personalised guidance based on your specific circumstances.

- Superannuation Fund Resources: Many super funds offer online tools, calculators, and educational materials to help members make informed decisions.

Seeking Professional Advice

While DIY retirement planning is possible, consulting a financial advisor can provide valuable insights and recommendations. A qualified advisor can assess your financial situation, set goals, and develop a tailored retirement plan.

Protecting Your Retirement Savings

Safeguarding Your Future

Proper planning is essential to protect your retirement savings and ensure a comfortable lifestyle.

- Estate Planning and Wills: A well-crafted estate plan outlines how your assets will be distributed after your death, protecting your loved ones from potential disputes.

- Reverse Mortgages: This option allows homeowners to access equity in their property, providing additional income in retirement. However, it should be carefully considered due to potential implications.

- Insurance Options: Consider insurance products like income protection, health insurance, and life insurance to safeguard your financial well-being.

Remember: Retirement planning is an ongoing process. Regularly review your financial situation, adjust your investment strategy as needed, and seek professional advice when necessary.

Downsizing and Lifestyle Changes

Benefits of Downsizing for Retirees

Downsizing can offer several advantages for retirees:

- Financial benefits: Reducing housing costs, property taxes, and maintenance expenses.

- Reduced stress: Less clutter and a smaller space to maintain.

- Increased mobility: Easier to travel and explore new places.

- Focus on what matters: The opportunity to declutter and prioritise possessions.

Financial Implications of Downsizing

While downsizing can lead to financial savings, it’s essential to consider the following:

- Sale of your home: Evaluate potential sale proceeds and potential capital gains tax implications.

- Purchase of a new home or rental property: Consider costs associated with buying or renting a smaller property.

- Moving expenses: Budget for costs related to packing, transportation, and settling into a new home.

- Financial advice: Consult a financial advisor to understand the overall financial impact of downsizing.

Lifestyle Adjustments for Retirement

Retirement often involves significant lifestyle changes. Here are some tips to adjust:

- Create a new routine: Establish a daily schedule that includes physical activity, social interaction, and hobbies.

- Build a support network: Connect with friends, and family, or join social groups for companionship.

- Explore new interests: Discover new hobbies or passions to enrich your life.

- Maintain physical and mental health: Prioritise exercise, nutrition, and cognitive stimulation.

Retirement Living Options

Aged Care Options

As people age, the need for additional care may arise. Here are some options:

- Home care: Receiving support services at home to assist with daily living activities.

- Retirement villages: Independent living communities with access to amenities and support services.

- Nursing homes: Providing comprehensive care for individuals with complex medical needs.

Retirement Living Communities

Retirement living communities offer various living arrangements, including:

- Independent living units: Apartments or houses within a retirement community.

- Assisted living: Provides support with daily activities while maintaining independence.

- Residential care: Offers 24-hour care for individuals with higher care needs.

Government Subsidies and Support

The Australian government provides various subsidies and support programs for retirees, including:

- Age Pension: A means-tested income support payment.

- Commonwealth Seniors Health Card: Entitlements to reduce costs for medications and medical services.

- Home Care Packages: Subsidised home care services for eligible seniors.

- Aged Care Funding Instrument (ACFI): Determines the level of government funding for residential aged care.

Note: Eligibility for government benefits and support varies based on individual circumstances. It’s essential to research and understand the available options.

Conclusion

Retirement planning is a crucial step towards a secure and fulfilling future for Australians. By understanding your goals, maximizing superannuation, exploring investment options, and considering lifestyle changes, you can create a comprehensive strategy to achieve financial independence.

Remember, early planning is key. Don’t delay in starting your retirement savings journey. Take advantage of the resources available, including government calculators, financial advisors, and superannuation fund information.

Intrinsic Finance is committed to helping you drive your dreams and finance your future. Our team of experts can provide personalised guidance and support throughout your retirement planning process.

Take the first step towards a secure retirement today. Contact us for a complimentary consultation.