Are you struggling to get behind the wheel due to bad credit? Don’t let it drive you crazy! There are ways to navigate this bumpy road and get the car you need. A credit score below 600 is generally considered bad in Australia. This can significantly impact your ability to secure a car loan with favourable terms. Lenders often view borrowers with bad credit as higher risks, leading to higher interest rates or outright rejection.

This guide aims to empower you with practical steps to improve your chances of getting a car loan, even with bad credit. We’ll cut through the jargon and provide clear, actionable advice.

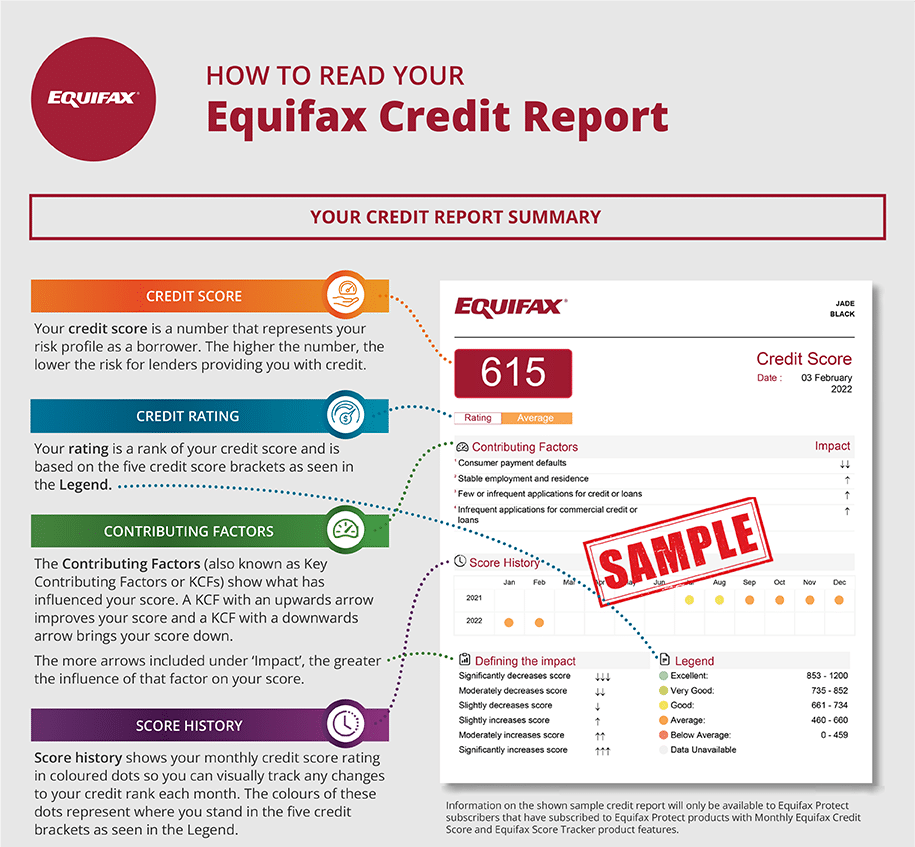

1. Understanding Your Credit Report

Your credit report is a detailed record of your borrowing history. In Australia, you’re entitled to one free credit report every three months from each of the three main credit reporting bodies: Equifax, Experian, and Illion.

Why Check Your Credit Report?

Your credit report is a crucial document in Australia, offering a detailed account of your borrowing history. It contains information on credit card balances, loan repayments, defaults, and public records like bankruptcies or court judgements. Lenders rely heavily on your credit report to assess your creditworthiness, which directly impacts your loan application approval and interest rates.

Here’s a breakdown of the benefits of regularly checking your credit report:

- Identify Mistakes: Errors on your report can significantly lower your credit score. Regularly checking allows you to spot and dispute any inaccuracies you find.

- Track Your Progress: Monitoring your credit report over time helps you gauge the effectiveness of your efforts to improve your credit score.

- Protect Yourself from Fraud: Checking your report can help you detect signs of identity theft early on. If you find suspicious activity, you can take steps to protect yourself, such as contacting the credit reporting bodies (CRBs) and placing a fraud alert on your file.

Tips for Checking Your Credit Report in Australia:

- Get Your Free Copy: You’re entitled to a free credit report every three months from each of the three major CRBs in Australia: Equifax, Experian, and Illion. You can request reports online at their respective websites, by phone, or by mail.

-

Stagger Your Requests: Spread your requests throughout the year for a more comprehensive credit health picture. Aim for one report from each bureau every three months.

-

Review Thoroughly: Don’t just skim! Take your time and carefully review each section for any errors or inconsistencies. Pay close attention to:

- Personal details like name, address, and date of birth.

- Account information such as credit cards, loans, and mortgages.

- Public records, including bankruptcies, court judgements, and tax liens.

-

Dispute Errors Promptly: If you find any errors on your report, contact the specific CRB that reported the error and file a dispute. You can usually do this online or by mail. The CRB is legally obligated to investigate your dispute and respond within 30 days.

2. Improve Your Credit Score

Improving your credit score takes time, but it’s essential for better loan terms. Here are some practical steps:

- Consistent Payments: Timely payments are the cornerstone of good credit. Make it a priority to pay all bills, including credit cards, loans, and utilities, on time. Consider setting up automatic payments to avoid missing deadlines.

- Lower Your Credit Utilisation: Credit utilisation refers to the percentage of your credit limit you’re using. Aim to keep it below 30%. Paying down credit card balances can significantly boost your score.

- Build Positive Credit History:

- Secured Credit Card: A secured credit card requires a cash deposit, which becomes your credit limit. Responsible use can help build positive credit history.

- Authorised User: Becoming an authorised user on someone else’s credit card (with good credit) can positively impact your credit score, if reported. However, ensure the primary account holder is responsible.

3. Finding a Lender

Securing a car loan with bad credit can be challenging, but there are options:

- Specialised Lenders: Some lenders focus on borrowers with less-than-perfect credit. These lenders often have higher interest rates, but they can be a lifeline.

- Online Lenders: Online platforms offer convenience and might cater to borrowers with bad credit. However, interest rates can be high, and there’s a risk of scams. Thorough research is essential.

- Credit Unions: Credit unions are member-owned financial cooperatives that often offer more flexible lending criteria compared to traditional banks. They might be worth exploring.

- Intrinsic Finance: This Australian lender specialises in helping people with bad credit or no credit history get into a car. They offer tailored financing solutions with competitive rates and flexible terms.

Remember: Securing a loan with bad credit might mean higher interest rates. Carefully compare offers and consider the total cost of ownership before making a decision.

Additional Tips for Finding a Lender

- Shop around: Compare offers from multiple lenders to find the best deal.

- Consider a co-signer: Having a person with good credit co-sign your loan can improve your chances of approval.

- Be transparent: Be honest about your financial situation with potential lenders.

- Consider a larger down payment: A larger down payment can offset your credit score challenges.

By following these steps and exploring different lending options, you can increase your chances of securing a car loan that fits your needs.

4. Negotiating the Loan

Securing a car loan with bad credit often comes with additional challenges. Understanding the landscape can help you navigate the process effectively:

- Higher Interest Rates: Expect to pay a higher interest rate compared to borrowers with good credit. This is a common practice in the lending industry to offset the perceived higher risk.

- Larger Down Payment: A substantial down payment can significantly improve your loan terms. Lenders often view larger down payments as a sign of financial responsibility, potentially leading to better interest rates and loan amounts.

- Additional Fees: Be prepared for potential fees associated with bad credit loans. These might include higher loan origination fees or other charges. Carefully review the loan agreement to understand all costs involved.

5. Alternative Financing Options

If securing a traditional car loan proves difficult, consider these alternatives:

- Car Lease: Leasing might be an option, especially if you prefer to drive a newer car without the long-term commitment of ownership. However, credit checks are still typically required, and terms may be less favourable for those with bad credit.

- Buying a Used Car: Used cars generally cost less than new ones, making it easier to save for a down payment. A smaller loan amount can improve your chances of approval.

- Saving Up for a Down Payment: Building a substantial down payment can significantly enhance your loan application. The more you can save, the better your chances of securing a loan with favourable terms.

Remember: Improving your credit score is an ongoing process. By making consistent payments and reducing debt, you can gradually improve your financial standing and future loan options.

While securing a car loan with bad credit is a significant step, it’s also an opportunity to improve your financial situation. Here’s how:

- Responsible Borrowing: Continue to use your credit cards responsibly. Make sure to pay your balance in full each month to avoid interest charges. This helps maintain a good credit utilisation ratio and demonstrates responsible credit management.

- On-Time Payments: Making consistent, on-time payments on your car loan is crucial for rebuilding your credit. A positive payment history is a significant factor in determining your credit score.

- Monitoring Your Credit Score: Regularly checking your credit report allows you to track your progress. Look for any errors and dispute them promptly. Additionally, monitor your credit score for improvement.

Conclusion

Securing a car loan with bad credit can be challenging, but it’s not impossible. By understanding your credit, exploring different lending options, and making responsible financial decisions, you can navigate the process successfully. Remember, building good credit takes time, but it’s a worthwhile investment in your financial future.

Key takeaways:

- Check your credit report for errors.

- Understand your credit score and how it impacts loan terms.

- Explore specialised lenders, online platforms, and credit unions.

- Be prepared for higher interest rates and additional fees.

- Consider a larger down payment to improve your loan terms.

- Make consistent payments on your car loan to rebuild your credit.

Taking proactive steps to improve your credit score will not only benefit you in the long run but also open doors to more financial opportunities.

Start your journey towards better credit and car ownership today!

Intrinsic Finance: Drive Your Dream Today

Don’t let bad credit hold you back. Intrinsic Finance offers tailored financing solutions to help you get into the car of your dreams. Apply now and start driving your future.